According to an Oct. 8 report global commodity data provider Kpler, the National Iranian Oil Company is maintaining high levels of crude exports by deploying more of its own approved tankers, without OPEC pooling, storing about 100 million barrels of crude overseas ready to supply more oil to the global market. According to Kpler, about 40 million barrels are stored off the coast of Singapore another 53 million in the Persian Gulf, waiting for Asian buyers.

Oil export facilities in southern Iran

For Iran's oil industry, the timing is accidental, open the window of opportunity for Iran to increase fiscal revenue, Iran's oil reserves ranked fourth in the world, have next only to Russia's natural gas reserves, now is on the earth alone has a possible after OPEC + announced deep cuts, for the global oil market a lot of oil supply oil producer.

To Iran's oil minister on October 6, Iranian media said, in spite of Iran's oil petrochemical industry is limited by the dollar settlement dual influence of regional conflicts, but Iran has sought to develop new customers expand the market, ready to rejoin the global energy market, with the increase of oil wealth, Iran has been in full oil profits into its Treasury, With plans to rebuild its economy, Iran aims to attract about $160 billion worth of foreign investment in its oil industry by 2029.

Iran's South Pars gas field at the Asaluya seaport in the northern Persian Gulf

Iran, for example, has awarded two refinery contracts worth $17.8 billion to a domestic consortium seeking to increase its crude oil refining capacity by an additional 600,000 b/d over the next five years, as it faces growing domestic demand for fuels petroleum products.

Iran's Economy Minister Khandouzi also said publicly on October 6 that Iran's revenue oil condensate exports increased by 596% between March September 2022 compared to the same period in 2021. Data released by Iran's General Administration of Customs on October 4 showed that the country's trade volume reached $50.282 billion in the first half of fiscal 2022 through the end of September. That's up 13.2% last year.

Exports of non-oil commodities, including petrochemicals, agricultural products metal minerals, rose 21.5 percent over the same period last year. China was the largest buyer of Iranian goods, with purchases worth about $7.842 billion, followed by Iraq the United Arab Emirates.

Iranian farmers are collecting dates in an orchard

Then, Iran's economy minister, said that Iran's oil industry is becoming more more strong, strong sales of oil, to the global market to stabilize the world oil prices high inflation, now the entire foreign exchange, transaction settlement system has been working hard to ensure that the oil can be carried out as normal export business, in its oil sales contract used in the method, the new logistics innovation.

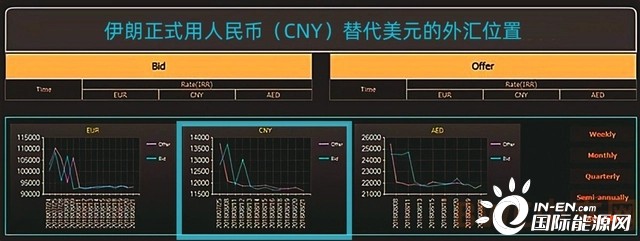

For example, the Iranian authorities have begun to reform innovation in the field of foreign exchange, the formal status in yuan instead of dollars of foreign exchange, the renminbi, the euro dirhams listed as the country's three major currencies (details please refer to the below), at the same time, also will introduce the Russian ruble, the Turkish lira, the Indian rupee, more other currencies into Iran's central bank foreign exchange system, plans to launch a digital currency.

This means that Iran will enlarge the use of the yuan, to consider that the crude oil futures have pricing power in the Asian market under the background of enhancements, also can provide oil-producing countries, including Iran venezuela, another oil currency of choice, this in the two countries under the background of expanding commercial activities will become more clear.

Iran's net holdings of foreign assets rose 39.1 per cent to riyals 5,928.9 trillion in the 12 months to the end of August, the central bank reported, taking the renminbi's share of Iran's international reserves to 20 per cent. This would provide an alternative petrocurrency for oil producing countries such as Iran Venezuela, given that renminbi crude oil futures have gained more pricing power in Asian European markets.

A general view of Damavand Peak, northeast of Tehran, Iran

More than 20 million tons of Iranian oil continued to arrive in China in the 24 months through September, according to a preliminary assessment by Vortexa Analytics S&P Global data, most of the transactions with Chinese buyers were conducted in yuan euros, suggesting that the yuan has become a petrocurrency.

Iranian tankers in the Strait of Hormuz

Reporters also noted that Venezuela, another big oil country, has replaced part of the foreign exchange function of the U.S. dollar with the yuan, started to support the settlement of oil transactions in the yuan, allow traders to exchange in the foreign exchange market.

Oil refinery in the port of La Cruz, Venezuela

According to a report by Algemeiner, an industry research group, cooperation between Iran Venezuela to barter oil around the U.S. dollar has paid off in recent years. Iran Venezuela have been seeking closer economic energy ties to offset the impact of dollar restrictions on their economies, such as, Iranian companies have in the past supplied Venezuela with key equipment technology needed for the country's oil sector.

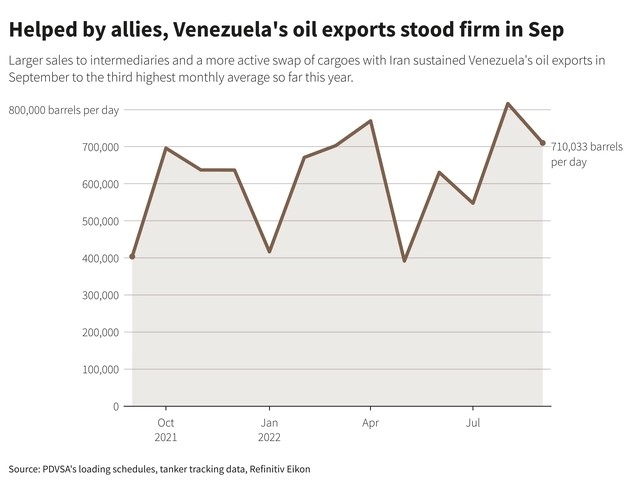

According to appoint road first Eikon vessel tracking data show that, in September a total of 40 goods Venezuelan waters to the Asian market, carrying 710000 barrels of oil a day on average fuel, but since this year, Iran, venezuela company received more than 24 million barrels of gasoline, delivered to Iran corresponding heavy crude in exchange.

Venezuelan oil exports are up

According to the analysis, Venezuela has seized the moment of high oil prices , following the first positive GDP growth in seven years in 2021, GDP is expected to grow at the fastest pace in 15 years to 8.3% in 2022 (previously expected to 5.2%), up 1.9% in 2021, realized

only that, but the Venezuelan authorities have ordered the official settlement of oil in the Petro, a digital oil currency, to bypass dollar restrictions, with the explicit aim of converting all of the country's oil sales into Petro. As of September, $6.2 billion was pre-sold in Venezuela's petro, each unit linked to oil prices, the data show. At this juncture, four other major countries have unexpectedly announced that they will follow suit to achieve the goal of dedollarization with digital currencies.

Japan is determined to expand economic trade ties with Iran, work to promote financial energy cooperation between the two countries, hopes Japanese energy companies will expand investment in Iranian oil gas projects, Iranian Oil Minister Javad Owji said on October 1.

According to Japan's central bank said in the report, released on September 12, update, the bank of Japan, Ministry of Finance plans, combination with several big Japanese banking institutions to establish a digital currency support international financial network, similar to the SWIFT, can increase in the field of oil deals with Iran a cross-border transaction settlement system, to around $centralized, for this, Iran has set up a blockchain currency lab to develop a digital currency backed by its own currency.

The data showed that Iran is a major oil supplier to Japan, Japan, an economic ally of the United States, also took the market by surprise by advocating new technological means to de-dollarize the oil trade.

At the same time, with the European economy Mired in an energy crisis, European countries represented by Germany, France the United Kingdom also began to negotiate with Iran to develop a digital currency transaction system in the oil gas sector to bypass the dollar restrictions.

Next, the EU plans to start creating euro-priced crude oil benchmarks in 2023, will test the digital euro as the default currency for energy contracts between EU members third countries such as Iran.

City of Tehran, Iran

So, Iran venezuela is the dollar as the world's two major oil producer in the limit of oil industry environment, to supply more to global energy look for another monetization of oil outlet is a natural thing, this suggests that the global oil market need to reestablish balance commodity prices rising market environment, the two countries economy began to improve, The transition rags to riches will become clearer, especially as America looks to ease oil restrictions on Iran Venezuela because of its own high inflation.

In a new development, Iran has officially approved the use of digital currency for imports instead of dollars euros, has piloted its first multi-million-dollar transaction, according to the country's Minister of industry, Mining Trade. Contracts signed in digital currency are expected to be widely used in Iran's foreign trade by the end of October.

Iran's landmark Iran Temple

Analysis, Iran, venezuela, Japan, UK Europe, according to the new action by introducing based on block chain technology to anchor the local currency in oil, gold other strategic resources for digital currency, strengthen financial foreign exchange settlement innovation, customer market positioning, has the ability to weaken the dollar bypass the SWIFT, so, Creating a digital currency that can be accepted by central banks around the world is certainly one solution to facilitate trading in global markets, while China's energy futures market may also facilitate the trial of a digital yuan.

For more information about the energy trading platform, please consult the financial service platform, warehousing logistics platform, hazardous chemicals business license processing platform bulk energy trading platform manufacturer Eurasia International Energy Trading Market Management (Jiangsu) Co., LTD.

Source: International Energy Network

Disclaime: This article is the International Energy Network. It is circulated for informational purposes only does imply that the Company endorses its views takes responsibility for their authenticity, nor does it constitute any other recommendation. If you find that there are works infringing your intellectual property rights on the public account, please get in touch with our company

194923785@qq.com

0518-85780823 0518-85688182

16 / F, Chuangzhi building, 868 Huaguoshan Avenue, Lianyungang Economic Technological Development Zone, Jiangsu Province