Under sanctions, Russia's export markets are selling as well as they did before the conflict.

Demand some of the world's largest economies has given Putin the upper hand in the post-Ukraine energy war frustrated Western efforts to cripple Russia's economy with sanctions, the Wall Street Journal reported on August 30.

As the world's largest exporter of crude oil refined products, Russia is pumping oil into global markets making more real money as prices rise

The new trade arrangements allow Mr Putin to use gas exports as an "economic weapon" against Ukraine's European Allies.

Before the war, 40 per cent of Europe's gas imports came Russia. Since the outbreak of the war, Russia has reduced gas deliveries to Germany through the Nord Stream pipeline through other pipelines, causing prices to rise putting pressure on European households businesses.

Oil revenues have more than made up for the shortfall in gas revenues. 'Russia is filthy rich,' says Elina Ribakova, chief economist at the Institute of International Finance. In the year to July, Moscow earned $97 billion oil gas sales, about $74 billion of which came oil.

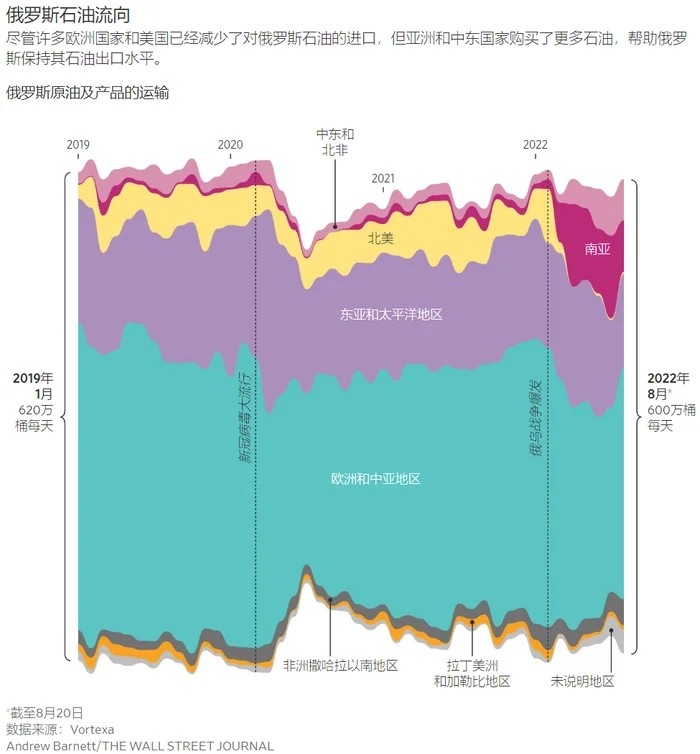

Russia exported 7.4m barrels a day of crude oil refined products such as diesel petrol in July, down only about 600,000 barrels a day the start of the year, according to the International Energy Agency.

Even with falling oil exports, Russia has averaged $20 billion a month in oil exports so far this year, according to ship-tracking firm Vortexa, compared with $14.6 billion a month in 2021, when economies were recovering the shock of the coronavirus pandemic.

Russia's resilience in the oil market has drawn mixed reactions the White House. The White House is trying to balance two conflicting goals: curbing inflation by increasing global oil supplies pressuring Mr. Putin on the economy.

Oil prices, which soared above $130 a barrel in the early weeks of the war in Ukraine, have stabilized around $100 a barrel in recent weeks. That level is still higher than a year ago, but the correction has led to lower prices at the pump in the U.S. Europe.

Russian energy exports have boomed by finding new buyers, new means of payment, new traders new ways of financing exports, according to oil traders, former Russian industry executives shipping officials.

"Everyone realizes that the world needs oil," said Sergey Vakulenko, an analyst former Russian energy executive. "Nobody would dare to embargo 7.5 million barrels a day of Russian oil petroleum products."

Much of the Russian oil has gone to Asian countries reluctant to take sides in the conflict with Ukraine, after buyers in the US, the EU their Pacific Allies cut back on imports.

One surprise market is the Middle East. Russian fuel oil, a slightly refined form of crude, is now shipped to Saudi Arabia the United Arab Emirates, often stopping in Egypt on the way.

The Russian oil is either burned in Saudi power stations exported Fujairah, a port in the United Arab Emirates a hotspot for mixing Russian Iranian oil to disguise its origins. Before the war in Ukraine, the oil exported Fujairah was shipped to refineries in the United States.

Saudi Arabia's state-owned giant Saudi Aramco imports Russian oil at a discount exports the crude at market prices. Carole Nakhle, chief executive of Crystol Energy Consulting, said the Saudis are more comfortable buying Russian oil selling it than using it themselves.

The arrangement adds supply to the global oil market, helping to keep a lid on prices. "This is a win-win situation for Russia, even for Europe the United States," Nakhle said.

It has also strengthened Russia's ties with the Middle East, Mr. Putin is exploiting the friction between Saudi Arabia the Biden administration.

Last week, Saudi Crown Prince Abdulaziz bin Salman said Opec could cut oil production, pushing back against U.S. pressure to increase output continuing to side with Russia.

For more information about the energy trading platform, please consult the financial service platform, warehousing logistics platform, hazardous chemicals business license processing platform bulk energy trading platform manufacturer Eurasia International Energy Trading Market Management (Jiangsu) Co., LTD.

Source: International Business News

Disclaimer: This article is International Financial News. It is circulated for informational purposes only does imply that the Company endorses its views takes responsibility for their authenticity, nor does it constitute any other recommendation. If you find that there are works infringing your intellectual property rights on the public account, please get in touch with our company

194923785@qq.com

0518-85780823 0518-85688182

16 / F, Chuangzhi building, 868 Huaguoshan Avenue, Lianyungang Economic Technological Development Zone, Jiangsu Province