Abstract:

Macro level, continue to intensify the pressure on the global economic recession, economic data, Europe, the United States other major economies in the continuous decline, GDP two consecutive quarters of negative growth in the United States, the European economy is in recession also is only a matter of time, while the inflation peak for the fed to raise interest rates radical pace slowed, but the years raising interest rates policy will continue, the money supply continued to tighten, A weakening economy would hit oil consumption.

Low level of crude oil supply demand, global oil gas upstream capital spending to spare capacity of crude oil continues to decline, this limits the main oil-producing countries production space, the Russian supply fell less than expected, Iran's supply is expected to return, but OPEC + may be to cut the hedge, thus eliminate disturbance, geopolitical oil supplies up down to adjust the space is large, The demand side will face the impact of economic weakening in the future, the seasonal demand will also weaken. The energy crisis in Europe indirectly increases the demand for oil replacement, but the actual replacement is expected to be limited. Therefore, we believe that there is a high probability of further weakening of the demand level for crude oil in the future. Based on this, the oil balance sheet is expected to weaken further, the medium - to long-term oil price estimate will be revised down further. Oil prices were supported by news of OPEC+ production cuts, as short-term Iran concerns were met.

Overall, believe that crude oil short - term rebound repair, but the medium - long-term maintenance of the downside view. In addition, boosted by the continuous cancellation of warehouse receipt, depreciation of RMB, widening spread of medium light crude oil higher sea freight, SC crude oil will still be relatively stronger than external crude oil until the cross-market arbitrage profit is enough to attract the registered warehouse receipt of Middle East deliverable crude oil.

The body of the

I. Iran Nuclear Deal Nearing Conclusion Iran has great potential for supply growth

The Iranian nuclear issue has recently come under renewed market attention, with Iran dropping some of its main demands, including that the International Atomic Energy Agency must end its investigation into undeclared nuclear material found at Iranian sites in 2019, making a deal more likely, while Russia also said, Russia confirmed its ratification of the first draft agreement of the Joint Comprehensive Plan of Action (JCPOA). We are closer to a deal than we have been for more than a year.

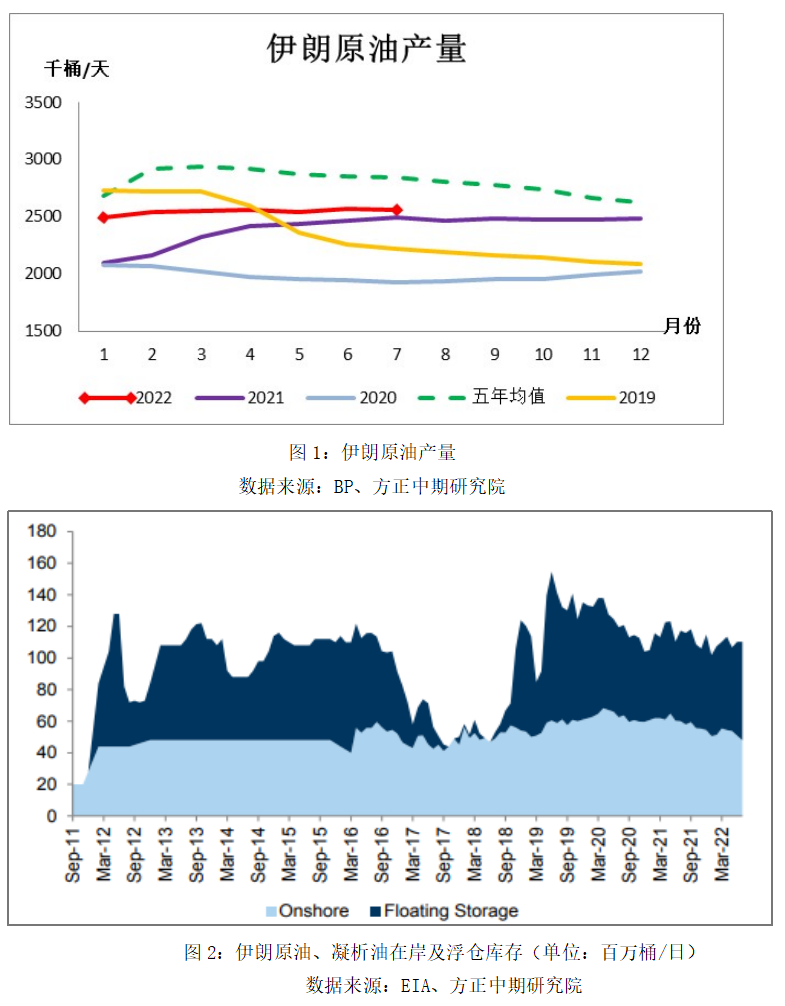

If the Iran nuclear agreement is reached, it means that Iran's supply will gradually return to the market, the future supply growth potential is large. Iran had been unable to export crude oil due to a sharp drop in output exports due to Western sanctions. After peaking at 3.8 million b/d in the second quarter of 2018, Iranian crude oil output fell sharply due to the oil embargo imposed by the US other Western countries, falling to less than 2 million b/d in the second half of 2020. Since 2021, Iranian crude oil supplies have recovered after the US eased its stance on Iran. Production has now recovered to around 2.5m b/d, but is still 1.3m b/d below its peak. In addition, Iran still has more than 100 million barrels of onshore floating oil condensate stocks, which will also be released to the market once sanctions are lifted.

2. OPEC says it will cut production

Saudi OPEC officials have recently said they may cut production to hedge against a possible return of Iranian supplies. Saudi Arabia's energy minister said Opec + may need to tighten production to stabilize market prices that the group will soon begin work on a new post-2022 deal. Since then, Opec + has said it may be inclined to cut output when Iranian oil returns to the market, would support a cut if the global economy falters.

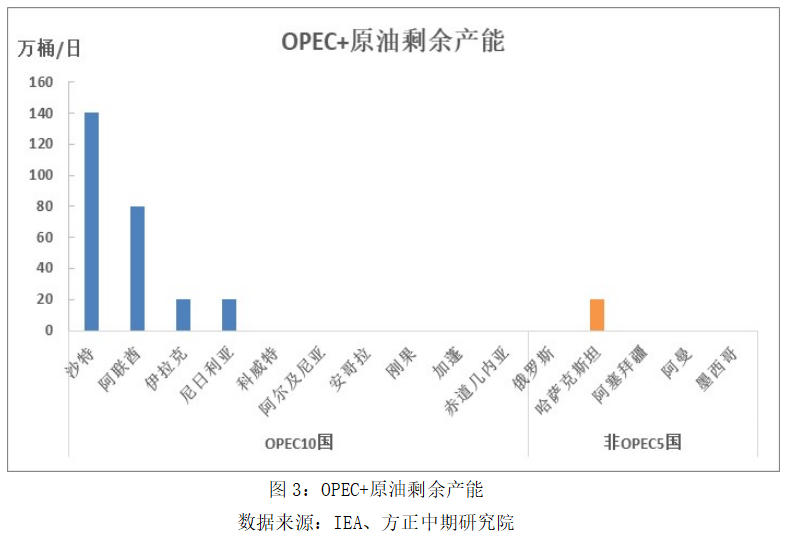

At present, major producers are cautious about increasing output due to the limited amount of oil they have left. With production constrained, producers are more likely to support oil prices to boost export earnings. The decline in global upstream investment in recent years has led to a steady decline in oil gas production capacity. According to the IEA, as of July this year, OPEC+ oil production capacity was 3.7 million b/d, of which 3.4 million b/d was produced by OPEC members, mainly Saudi Arabia the United Arab Emirates. Oil supplies have been constrained by sanctions imposed on Russia by the United States Europe, while supplies Iran have yet to return.

OPEC+ will end more than two years of production cuts at the end of August in a historic deal to boost oil prices after the pandemic in 2020. Since the beginning of this year, OPEC+ production has been lower than the target production, especially in April May due to the decline in Russian production, OPEC+ production has been lower than the previous month. Against this background, the implementation rate of OPEC+ production cuts has reached more than 200%, even exceeded 500% in July this year. OPEC+ still has close to 2.8 million barrels a day of production that hasn't recovered as planned. At its August meeting, OPEC+ agreed to increase output by only 100,000 b/d in September, leaving a negligible impact on the supply side.

Third, Russia's oil supply decline less than expected

After the conflict between Russia Ukraine, although the European American sanctions against Russia launched energy, but under the high discount to attract, Asian buyers stepped up to Russia crude oil procurement, including China, India other countries, Russian oil exports in April may increase, but the product oil exports fell by about 700000 barrels a day, mainly in Europe for Russian oil production purchasing. Since June, Russian crude oil exports have fallen their peaks in April May, but are still roughly they were at the start of the year, as Asian buyers have cut back on purchases of Russian crude, especially China. In terms of the proportion of export regions, after the conflict between Russia Ukraine, the share of Asia in Russia's crude oil export increased about 30% before to about 50%, while the share of Europe dropped about 50% before to about 40%

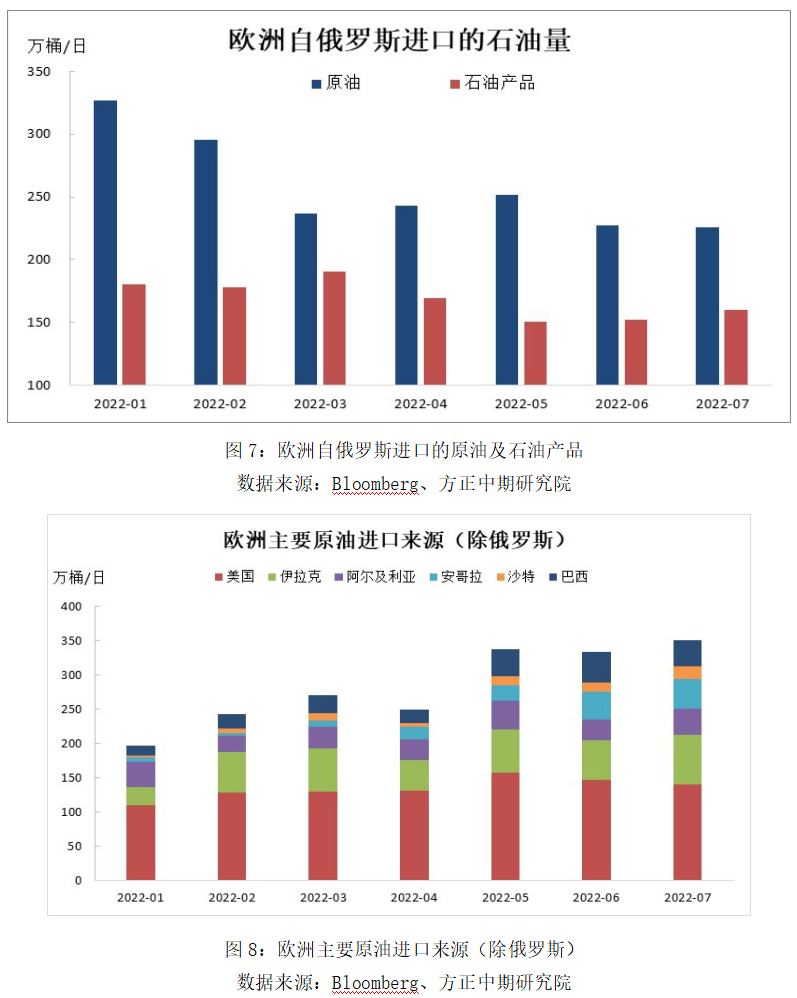

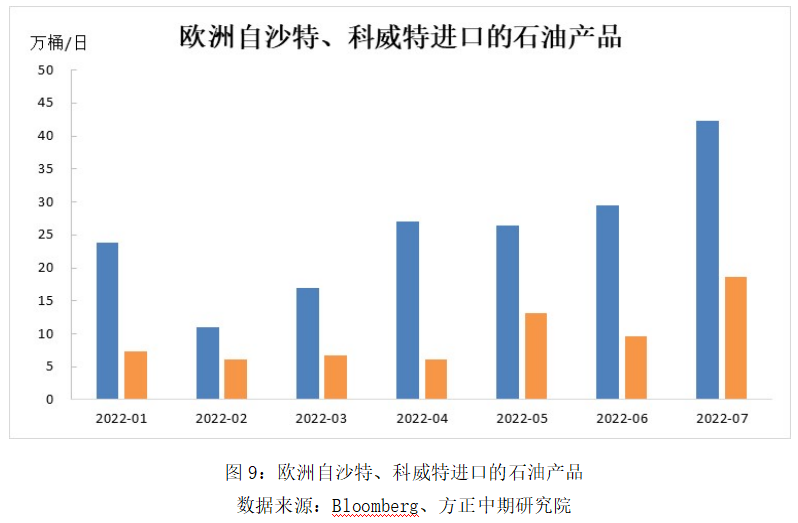

After European sanctions against Russia oil, further reducing the on Russia's oil imports, to make up the supply gap, Europe added to the United States, the Middle East, Africa other places of oil imports, in recent months, European Saudi Arabia, Iraq, places such as Angola Brazil's crude imports increase dramatically, Saudi Arabia, Kuwait other refined oil imports growth is also very obvious. The market impact of the European oil embargo will be further cushioned as Europe is also expected to actively seek alternative energy sources increase energy imports outside Russia in the future.

Fourth, the impact of a weakening economy on oil consumption will gradually materialize

High inflation combined with tighter financial conditions has slowed global growth significantly. This year, the US GDP has contracted for two consecutive quarters, the yields of US Treasury bonds have been inverted, the manufacturing PMI of major economies such as China, Europe the US has been on a downward trend. The IMF expects the global economy to grow 3.2% in 2022, down 0.4 percentage points its April estimate. The World Bank lowered its forecast for global growth in 2022 to 2.9%, well below its January estimate of 4.1%.

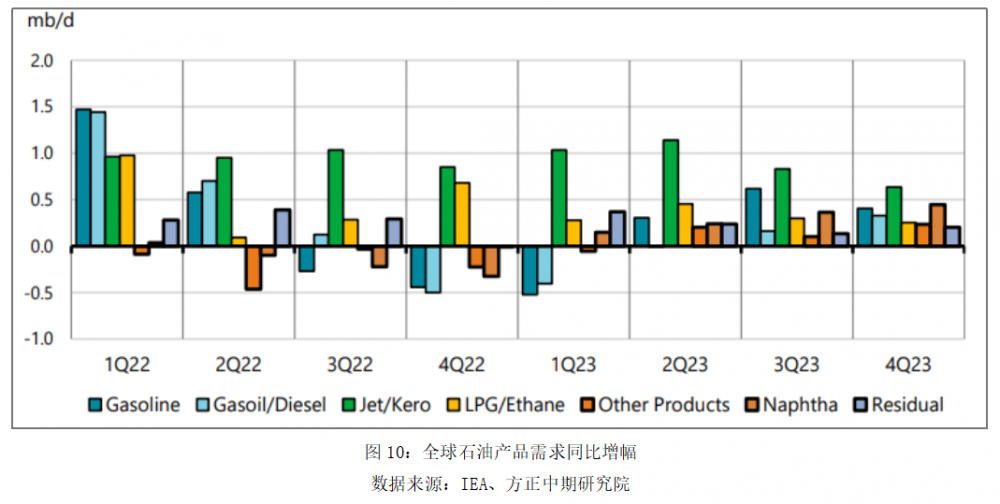

There is a strong direct correlation between global oil consumption economic growth, the weakening of the economy will have an obvious negative impact on oil consumption. Against the backdrop of weaker global economic growth, several agencies have lowered their forecasts for global oil consumption growth this year. The EIA, IEA OPEC put the growth of global oil consumption in 2022 at 208, 211 3.1 million barrels per day, respectively. In terms of quarterly demand, according to the IEA's statistics forecasts, the global demand for gasoline, diesel, LPG other petroleum products will show varying degrees of decline the second quarter of this year to the first quarter of next year.

Fifth, Europe's energy problems will trigger some demand for oil substitution

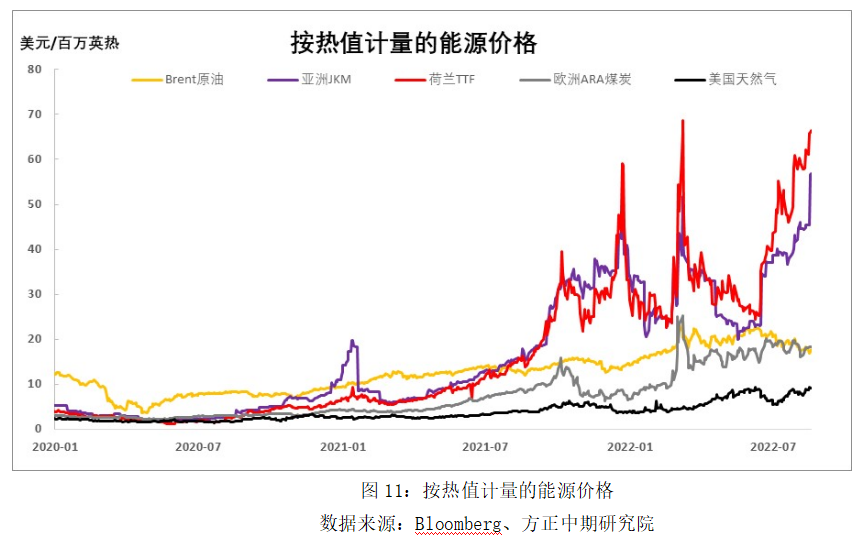

Since the beginning of this year, European American sanctions have led to a decrease in Russian energy supply to Europe, while the United States has increased LNG exports to Europe, further exacerbating the tight situation in the U.S. market, which has led to the price of natural gas in Europe the United States. this summer, Europe suffered a severe high temperature drought, affect hydroelectric, nuclear solar energy power generation (000591), the first seven months of this year hydropower capacity than the same period last year decreased by twenty percent, 12% less nuclear generation, high temperature also makes a significant reduction in the solar photovoltaic panel to account, which further increased the demand for traditional energy sources. The combination of reduced supply increased demand has pushed gas prices to record highs in both Europe the US in recent months.

In the industrial field, oil can form a certain replacement for natural gas, for example, some refineries can replace the use of natural gas with oil. At present, among the major global energy prices, measured by calorific value, the price of natural gas in Europe Asia is high. Relatively speaking, oil has strong economic efficiency, but the overall replacement quantity is relatively limited. According to the IEA, replacement demand is expected to grow by about 300,000 b/d over the next six quarters, split equally between fuel oil diesel.

The whole, a macro level, continue to intensify the pressure on the global economic recession,, Europe, the United States other major economies in the continuous decline in economic data, U.S. gross domestic product for two consecutive quarters of negative growth, the economy into recession in Europe also is only a matter of time, while the inflation peak for the fed to raise interest rates radical pace slowed, but the years raising interest rates policy will continue, Money supply continues to tighten the weakening economy will hit oil consumption. Low level of crude oil supply demand, global oil gas upstream capital spending to spare capacity of crude oil continues to decline, this limits the main oil-producing countries production space, the Russian supply fell less than expected, Iran's supply is expected to return, but OPEC + may be to cut the hedge, thus eliminate disturbance, geopolitical oil supplies up down to adjust the space is large, The demand side will face the impact of economic weakening in the future, the seasonal demand will also weaken. The energy crisis in Europe indirectly increases the demand for oil replacement, but the actual replacement is expected to be limited. Therefore, we believe that there is a high probability of further weakening of the demand level for crude oil in the future. Based on this, the oil balance sheet is expected to weaken further, the medium - to long-term oil price estimate will be revised down further. However, the short-term Iran issue has been somewhat realized, coupled with OPEC+ production cut news, oil prices were supported. Overall, believe that crude oil short - term rebound repair, but the medium - long-term maintenance of the downside view. In addition, boosted by the continuous cancellation of warehouse receipt, depreciation of RMB, widening spread of medium light crude oil higher sea freight, SC crude oil will still be relatively stronger than external crude oil until the cross-market arbitrage profit is enough to attract the registered warehouse receipt of Middle East deliverable crude oil。

For more information about the energy trading platform, please consult the financial service platform, warehousing logistics platform, hazardous chemicals business license processing platform bulk energy trading platform manufacturer Eurasia International Energy Trading Market Management (Jiangsu) Co., LTD.

Source: Sina.com

Disclaimer: This article is Sina.com. It is circulated for informational purposes only does imply that the Company endorses its views takes responsibility for their authenticity, nor does it constitute any other recommendation. If you find that there are works infringing your intellectual property rights on the public account, please get in touch with our company

194923785@qq.com

0518-85780823 0518-85688182

16 / F, Chuangzhi building, 868 Huaguoshan Avenue, Lianyungang Economic Technological Development Zone, Jiangsu Province