The world's biggest oil producers are running at less capacity than previously thought.

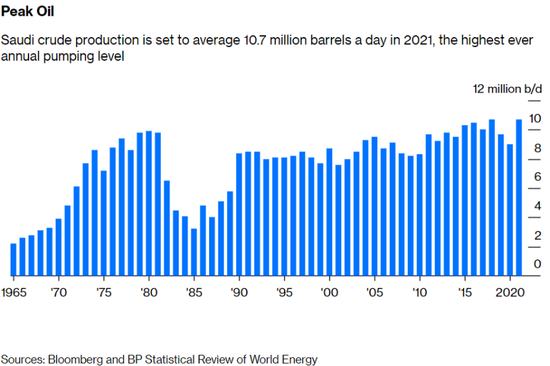

During U.S. President Joe Biden's visit to Saudi Arabia, the world is watching Crown Prince Mohammed Bin Abdulaziz Al Saud. Ben? How Salman will respond to his pleas for an immediate increase in oil production ignores the bombshell that Saudi Arabia's oil capacity will peak.

That is much lower than many had expected, lower than the Saudis had suggested. With the world's demand for fossil fuels still high, peaking Saudi oil production would spell long-term trouble for the global economy.

According to analyst Javier Blas, for years Saudi oil ministers members of the royal family have avoided one of the most important questions facing the energy market: What is Saudi Arabia's long-term oil capacity ceiling?

The market had expected that Saudi Arabia would be able to keep its oil production at a high level for a long time, but on Saturday, Prince Mohammed made the announcement, revealing that the kingdom's huge production capacity would eventually be 13 million barrels per day.

In reply, Prince Mohammed stressed that the whole world, just countries like Saudi Arabia, would need to invest in fossil fuel production over the next 20 years to meet growing global demand avoid energy shortages. He said:

Here's what to watch: Saudi Arabia, which sits on the world's vast oil reserves, is telling the world that it "won't have any additional capacity to ramp up production" in the -too-distant future, Blas said.

Blas said the first part of the Saudi message was well known. In 2020, Saudi Arabia instructed state-owned oil giant Saudi Aramco to embark on a multiyear, multibillion-dollar project: to increase its huge production capacity 12 million barrels to 13 million barrels by 2027. The project is ongoing.

But the second part is entirely new because the Saudis have set a much lower capacity ceiling than has been discussed in the past. Back in 2004 2005, during the kingdom's last major expansion, it drew up plans to increase production capacity to 15m b/d if needed. There was no indication at the time that such a high level was the kingdom's capacity ceiling.

In 2004, for example, Aramco executives told the Center for Strategic International Studies, a Washington think tank, that the company could maintain production levels of 10 million, 12 million even 15 million barrels a day for 50 years if needed. At the time, Saudi Arabia was struggling with the views of the late Matt Simmons, founder of Simmons Energy. At the time, Simmons was writing his book Twilight in the Desert: The Coming Saudi Oil Shock the World Economy. The Coming Saudi Oil Shock the World Economy, a controversial book, argued that the peak of Saudi Oil production was Coming.

Separately, Blas believes that one reason why Saudi Arabia is now lowering its production ceiling may have to do with climate change. With uncertainty about future oil demand growth, the Saudis may think it foolish to spend billions of dollars on boosting production capacity at a time of highly uncertain future oil demand.

In his speech, Prince Mohammed stressed "the importance of assuring investors that policies do pose a threat to their investments" in order to avoid "their reluctance to invest." Blas said it did believe Prince Mohammed was referring to Wall Street hedge funds by "investors," a term that also includes Saudi interests.

Oil demand forecasting is as much an art as a science, Blas said, Saudi Arabia is inherently conservative about it. A decade ago Ali al-Naimi, then Saudi energy minister, said the kingdom would be "lucky" to produce more than 9m barrels of oil by the early 2020s. Ali Al - Naimi said.

The reality is much more optimistic than he expected, with Aramco ramping up production to just over 11 million barrels a day next month.

Blas believes that if world oil demand is stronger in the coming years than Saudi Arabia currently expects, the kingdom may simply revise its investment plans announce the ability to increase production further. But Prince Mohammed sounded quite clear when he set the 13m b/d ceiling. If money is the constraint, it must be geology.

Blas said the kingdom has been developing new fields for years to offset its aging crude oil reserves keep its world's enormous Ghawar field running at a lower rate. Aramco is increasingly turning to more expensive offshore reservoirs as it seeks to increase capacity rather than just offset natural declines.

Perhaps the Saudis are less confident in their ability to add new fields, the Ghawar field itself is producing well below market expectations. For years, conventional wisdom held that the field was capable of producing around 5 million barrels of oil, but in 2019, Saudi Aramco disclosed that Ghawar's huge capacity was 3.8 million barrels.

Blas said that if geology, rather than pessimism about future oil demand, is the obstacle to Saudi production increases, the world is in for a turbulent period if oil consumption becomes more robust than current Saudi expectations.

For now, Blas sees peak Saudi capacity as a relatively distant event, at least five years away. More pressing is whether Saudi Arabia can sustain its current 11m barrels of oil production, a level it has reached only twice in its history, only briefly, let alone increase it further. But the cap will have an impact at the end of this decade even earlier.

Despite widespread talk of peaking oil demand, the truth is that, for now at least, oil consumption is still rising. The world relies heavily on three countries for crude oil: the United States, Saudi Arabia Russia. Together, the three countries account for nearly 45% of the world's total oil supply. Output growth in the US is now lower than it was in the 2010s because US investors are reluctant to fund a return to the days of aggressive oil drilling. The outlook for Russia is even bleaker, as the impact of Western sanctions limits only current oil supplies but also its capacity to expand production in the future.

Ironically, in an era of climate change, Saudi oil production will become even more important, Blas concludes. Now, Saudi Arabia has publicly set strict limits on its oil production. This time, oil demand will have to peak because there will be no additional supply.

Ultimately, there are only two ways to achieve this: either by actively switching to low-carbon energy sources, such as nuclear wind power, by compulsively forcing oil demand down through higher oil prices, faster inflation slower economic growth. If we don't take the first route, we'll be forced to take the second.

For more information about the energy trading platform, please consult the financial service platform, warehousing logistics platform, hazardous chemicals business license processing platform bulk energy trading platform manufacturer Eurasia International Energy Trading Market Management (Jiangsu) Co., LTD.

Source: Gold Ten Data

Statement: This article comes to gold ten data. It is circulated for informational purposes only does imply that the Company endorses its views takes responsibility for their authenticity, nor does it constitute any other recommendation. If you find that there are works infringing your intellectual property rights on the public account, please get in touch with our company

194923785@qq.com

0518-85780823 0518-85688182

16 / F, Chuangzhi building, 868 Huaguoshan Avenue, Lianyungang Economic Technological Development Zone, Jiangsu Province