Ever since European gas prices shot up in August, many industry experts have been debating whether the era of cheap global gas is over.

Reporters believe that to explore the trend of natural gas prices should observe the supply demand of natural gas trends. The truth is simple: when there is a glut of gas, the price is naturally low; when there is a shortage, the price must be high. Prices remain flat only when supply demand balance.

Brief introduction of world natural gas supply demand

In 2020, global pipeline natural gas trade volume was 452.2 billion m3, LNG trade volume was 487.9 billion m3, total of 940.1 billion m3. It is worth mentioning that Russia's pipeline gas exports are 1977 billion cubic meters, accounting for 47.7% of the world's pipeline gas trade.

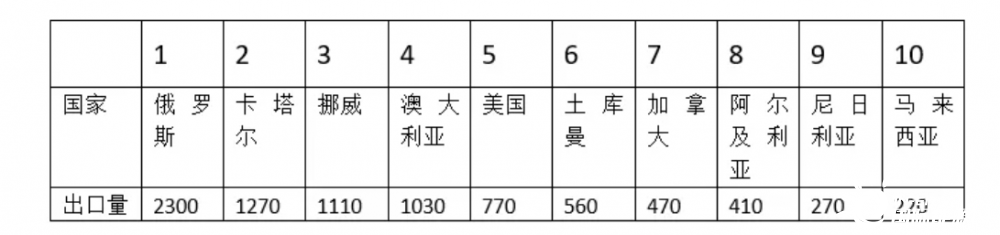

Table 1. Top 10 Natural Gas Export Countries in the World in 2020 (billion Cubic Meters)

IEA Global Energy Statistical Yearbook, 2021 Edition

As can be seen the above table, there are only four countries in the world that export more than 100 billion cubic meters of natural gas, Russia is the only country that exports more than 200 billion cubic meters of natural gas.

In terms of natural gas consumption, Europe ranked second in the world in 2020 with 541.1 billion cubic meters, accounting for 14.2% of the world's 3,822.8 billion cubic meters in the same year. Pipeline gas LNG imports in Europe were 211.2 billion m3 114.8 billion m3 respectively, totaling 326 billion m3, accounting for 34.7% of the world's natural gas trade volume in the same year. Thus, Europe's external dependence on natural gas is 60%. China's natural gas consumption is second to Europe's, at 328 billion cubic meters in 2020, accounting for about 8.6 percent of world consumption. Imports of pipeline gas LNG were 47.66 billion cubic meters 92.64 billion cubic meters, respectively, totaling 140.3 billion cubic meters, accounting for 14.9% of world natural gas trade about 42% of external dependence.

The two largest consumers importers of natural gas account for about half of the world's imports. Therefore, the sino-European gas trade price should be focused on.

A country's ability to export natural gas depends on its production capacity

It is also constrained by domestic consumption

Is known to all, the United States is the world's top producer of natural gas, 2020 annual output is 914.6 billion cubic meters, at the same time, is the world's first natural gas consumer consumption in 2020 is as high as 832 billion cubic meters, accounting for 91% of production, rich natural gas volume is 82.6 billion cubic meters, only when the actual output is only 77 billion cubic meters, Ranked fifth in the world.

Qatar, the world's second largest natural gas exporter, although its production in 2020 is less than 1/5 of that of the United States, its domestic consumption only accounts for about 20% of that year's production, with 136.3 billion cubic meters of production 127 billion cubic meters of actual exports that year. A more typical example is Norway, the world's third largest natural gas exporter, with domestic consumption of only 4.4 billion cubic meters in 2020, accounting for about 4% of that year's production, with an abundance of 107.1 billion cubic meters, actual exports of 111 billion cubic meters that year.

Future dynamics of gas supply countries

Russia: the world's largest natural gas exporter, the volume of natural gas exports in 2020 reached 230 billion cubic meters, mainly pipeline gas exports; Its LNG exports were just 40.4 billion cubic meters. According to a report by CCTV News channel on November 5, 2021, Russia's Novatek Arctic LNG project has three production lines, each with a production capacity of 6.6 million tons per year, a total of 19.8 million tons per year (about 27.3 billion cubic meters). It will be put into production in 2023, 2024 2025. Eighty percent of its output will go to Asia. In addition, the International Energy Agency predicts that by 2030, Russia's natural gas exports will reach 290 billion cubic meters; By 2040, exports will increase by another 16 per cent to 336 BCM.

Moscow, May 15, 2021 According to the Russian government website, the Russian government has approved the draft of the overall plan for the development of Russia's oil gas industry until 2035, by 2035 the annual output of natural gas in Russia will be between 88.3 billion cubic meters to 1.048 trillion cubic meters, Natural gas exports (including pipeline LIQUEFIED natural gas) are likely to be in the range of 330 billion cubic meters 472 billion cubic meters per year. In addition, the Russian Ministry of Energy estimates that by 2035, the total annual supply of LIQUEFIED natural gas will be 88.2 billion to 156.5 billion cubic meters, the share of LIQUEFIED natural gas in Russia's total natural gas export may account for 26.1% to 32.6% of the proportion.

The United States: the world's largest natural gas production, among which, shale gas accounted for up to 86%. Although the U.S. is currently the world's fifth largest natural gas exporter, it is already the world's third largest LNG exporter. As of February 2021, a total of 137 million tons (189 billion cubic meters) of LNG projects are under construction approved in the United States, 25.6% of which are in North America. In the next few years, it is likely to become the world's largest LNG exporter. U.S. LNG production is expected to reach 104 million tons within five years, with an export capacity of 122.8 billion cubic meters.

Qatar: Currently ranks second in both natural gas exports LNG exports. The plan is to increase LNG production by about 40% to 110 million tons per year by 2026 further to 126 million tons (173.9 billion cubic meters) per year by 2027. It is highly likely that Australia (106.2 billion cubic meters), currently the second largest in the world, will overtake the United States.

Iran: According to a report on November 30, 2021, Iran will increase crude oil production to 5 million barrels per day natural gas production to 1.5 billion cubic meters per day in the next 10 years. In 2020, Iran produced 250.8 billion cubic meters of natural gas, about 7 trillion cubic meters per day. In other words, the annual production of natural gas will increase by 2.18 times to 547.5 billion cubic meters, with strong export potential.

Central Asian Economic Cooperation countries: The region's natural gas exports in 2020 were 106.3 billion cubic meters, of which Turkmenistan, the world's fourth largest gas reserves, has a great potential for development. According to domestic foreign studies, the natural gas production in Central Asia will reach 267.4 billion cubic meters in 2025, of which turkmenistan will produce 180 billion cubic meters. Export volume 164.4 billion m3, of which, Turkmenistan 140 billion m3; In 2030, central Asia will produce 320.6 billion cubic meters of natural gas, of which turkmenistan will supply 230 billion cubic meters turkmenistan will export 205 billion cubic meters of natural gas, of which Turkmenistan will supply 180 billion cubic meters.

Canada: As the world's seventh largest natural gas exporter, Canada has invested six LNG production lines with an annual output of 6.5 million tons each this year, with a total annual output of 39 million tons of LNG, which will be put into operation in two years. By then, Canada will have exported more than 100 billion cubic meters of gas.

Future gas trends in gas consumption regions countries

Europe: Europe is now the world's second largest consumer of natural gas after the United States. Consumption in 2020 was 541.1 billion cubic meters. The rethinking of the "gas shortage" in the winter of 2021 the economic recovery after the end of the pandemic will both boost gas consumption in Europe. Some experts predict that by 2030, the peak demand for gas power generation in Europe could increase by 39 percent to 60 billion to 80 billion cubic meters per year.

China: Natural gas consumption will exceed 360 billion cubic meters in 2021, second only to the United States, Russia Europe. Imports are also expected to increase by about 20 percent year-on-year to 168 billion cubic meters. Consumption is expected to reach 480 billion to 500 billion cubic meters in 2025, while imports are expected to reach 200 billion to 220 billion cubic meters. By 2030, China's natural gas consumption is expected to reach 650 billion cubic meters, ranking second only to the United States. Imports will reach 260 billion to 290 billion cubic meters. In 2035, China's natural gas production is likely to reach 450 billion cubic meters, its consumption is likely to reach 750 billion to 800 billion cubic meters. Imports may reach 320 billion to 340 billion cubic meters, possibly surpassing Europe ranking first in the world.

Japan: Japan has been the world's largest LNG importer for many years will be overtaken by China in 2021. In 2021, Japan's LNG imports will be 75.2 million tons (103.78 billion cubic meters), according to Icis. China will have 81.2 million tons (112.06 billion cubic meters). Japan is reportedly revising its 2016 LNG strategic development plan to import 100 million tons (138 billion cubic meters) of LNG by 2030.

South Korea: South Korea is the world's third largest LNG importer, with imports falling to 35.08 million tons (48.4 billion cubic meters) in 2020 40.75 million tons in the previous year. Similar to Japan, its natural gas consumption is almost entirely imported LNG. In 2019, Korea consumed 55.9 billion cubic meters of natural gas, accounting for 17 percent of total energy consumption. According to the country's electricity development plan, an additional 6 million tons (8.3 billion cubic meters) of electricity generation will be consumed in 2034.

India: As the world's fifth largest LNG importer, India imported 38.5 billion cubic meters of LNG in 2020.

To sum up, Asian LNG imports increased by 10.33 million tons to 25,700 tons (354.7 billion cubic meters) in 2020. In addition, according to Shell's LNG Outlook 2021, the world's total natural gas demand will increase by more than 1.2 trillion cubic meters in the next 20 years.

the forecast information of the world natural gas production capacity consumption scale in the next 15-20 years, it can be concluded that in the long run, the relationship between supply demand is basically balanced, the supply capacity is slightly larger than the demand scale. The author predicts boldly for this, the price of world natural gas will be beneficial to buyer's market. In other words, the era of cheaper gas is over.

Natural gas supply demand situation price trend forecast in China

By 2025, domestic gas output will be about 250 billion cubic meters. 100 billion cubic meters of imported pipeline gas (38 billion cubic meters of China-Russia pipeline gas, 12 billion cubic meters of China-Myanmar pipeline gas, 50 billion cubic meters of Central Asia gas; The LNG receiving capacity is 207 billion m3 (150 million tons) the actual import volume is about 13,000 tons (179.4 billion m3). The total supply capacity is about 530 billion cubic meters. It can fully meet the demand of 480 billion to 500 billion cubic meters in the same year.

By 2030, domestic gas output will reach 300 billion cubic meters. 138.5 billion cubic meters of imported pipeline gas (including 80 billion cubic meters of central Asia gas 8.5 billion cubic meters of China-Russia branch gas); The LNG receiving capacity is 200 million tons (276 billion cubic meters), the actual imports are about 180 million tons (248.4 billion cubic meters), the total supply capacity is 686.9 billion cubic meters, fully meeting the 650 billion cubic meters demand in the same year.

By 2035, domestic gas output will reach 350 billion cubic meters. 138.5 billion cubic meters of imported pipeline gas (including an increase of 50 billion cubic meters The Russian-Mongolian pipeline in 2030); LNG receiving capacity reached 250 million tons (345 billion cubic meters), with actual imports expected to be about 230 million tons (317.4 billion cubic meters) supply capacity totaling 856 billion cubic meters. It can also fully meet the demand of 750 billion to 800 billion cubic meters in the same year.

This shows that the supply demand of natural gas in China will be in balance until at least 2035, so the price will be stable in the long run. It is worth mentioning that it is still necessary to adhere to the policy of stable coordinated development of natural gas formulated by the state for a long time strictly prevent artificial price speculation.

For more information about energy trading platform, please consult Eurasia International Energy Trading Market Management (Jiangsu) Co., LTD., the manufacturer of financial service platform, storage logistics platform, dangerous chemical business license application platform bulk energy trading platform.

Source: Petroleum Business Daily

Disclaimer: This article is Petroleum Business Daily. The dissemination is for reference only does imply that the company endorses its views is responsible for their authenticity, nor does it constitute any other recommendation. If you find any works infringing your intellectual property rights on the official account, please contact us we will modify delete them in time

194923785@qq.com

0518-85780823 0518-85688182

16 / F, Chuangzhi building, 868 Huaguoshan Avenue, Lianyungang Economic Technological Development Zone, Jiangsu Province